Source: ETF Trends

A combination of economic policy and geopolitical factors have been weighing down on silver thus far this year. However, a rebound could be brewing for the precious metal before year’s end.

The effect of higher interest rates have been well-documented with regard to their effect on silver prices. But as mentioned, geopolitical forces are also in play—namely, China’s struggles with economic growth.

“The recent increase in gold/silver ratio was triggered by the problems in the Chinese economy, which is an important source of demand for silver,” FX Empire noted. “Chinese authorities realize that they must provide additional stimulus to boost growth.”

The second-largest economy is still feeling the effects of a real estate development crisis. Still, as FX Empire mentioned, the government is doing what it can to resuscitate the economy. If the stimulus measures prove effective, it could translate to increased demand for silver.

“They have already implemented various measures that should have a positive impact on the economy in the upcoming months, boosting industrial demand for silver and pushing the gold/silver ratio towards the July lows near the 78 level,” FX Empire added.

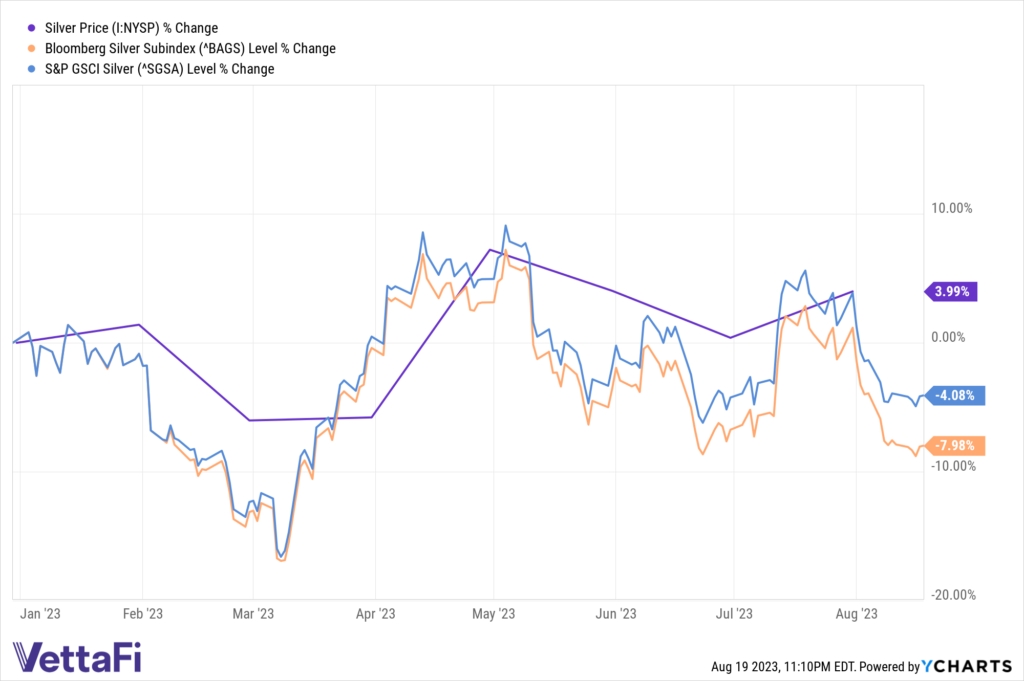

Of course, higher interest rates have affected silver the same way they have applied downward pressure to gold. As such, indexes linked to silver have been heading lower. However, a potential rebound could result if the central bank loosens its grip on monetary policy.

Silver to Benefit From Weaker Dollar

It’s widely expected that the U.S. Federal Reserve will eventually pivot from its tight monetary policy as it looks to finally get inflation under control. Once the rate hikes pause and eventually turn into rate cuts (whenever that may be), a weaker dollar should translate into more strength for silver.

“A combination of a weaker dollar and lower gold/silver ratio should provide sufficient support to silver and push it away from recent lows,” FX Empire added.

In the meantime, investors can get silver exposure with the Sprott Physical Silver Trust (PSLV). The fund provides silver exposure without the additional hassle of storing the precious metal—it invests in unencumbered and fully-allocated London Good Delivery (LGD) silver bars.

Additionally, shareholders also have the option to redeem their shares for physical bullion anywhere in the world (subject to certain minimum conditions). Redemptions of shares do not dilute the trust’s exposure for remaining shareholders still invested in the fund.

For more news, information, and analysis, visit the Gold/Silver/Critical Minerals Channel.